when is capital gains tax increasing

Rumours are circulating that Hunt is looking at tinkering with Capital Gains. 14 October 2022.

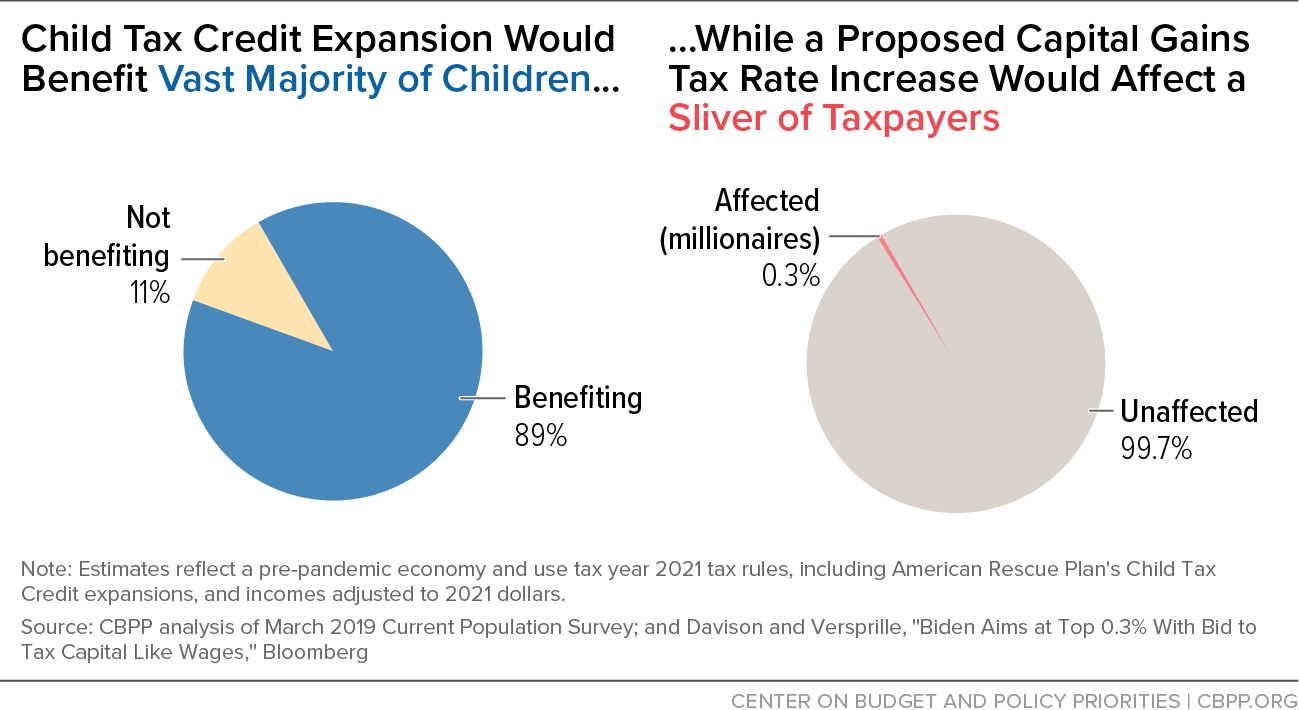

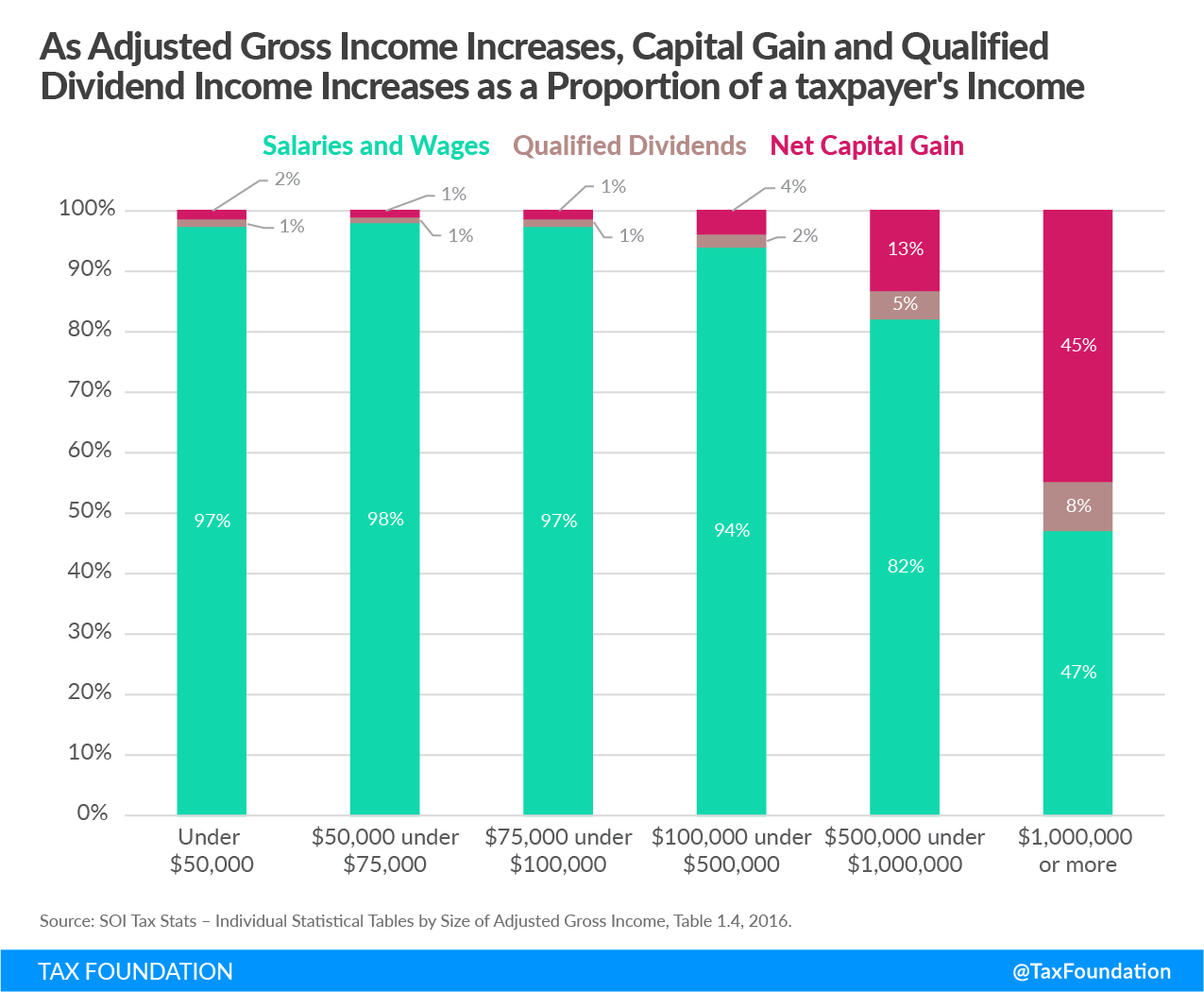

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities

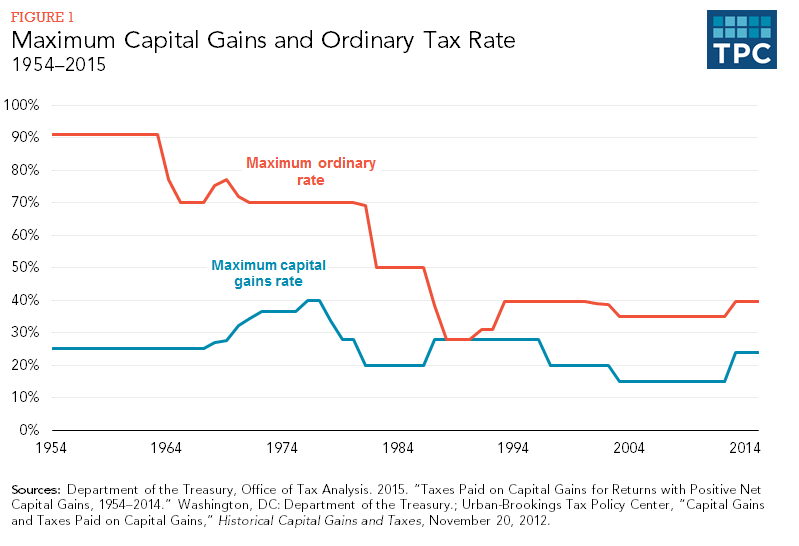

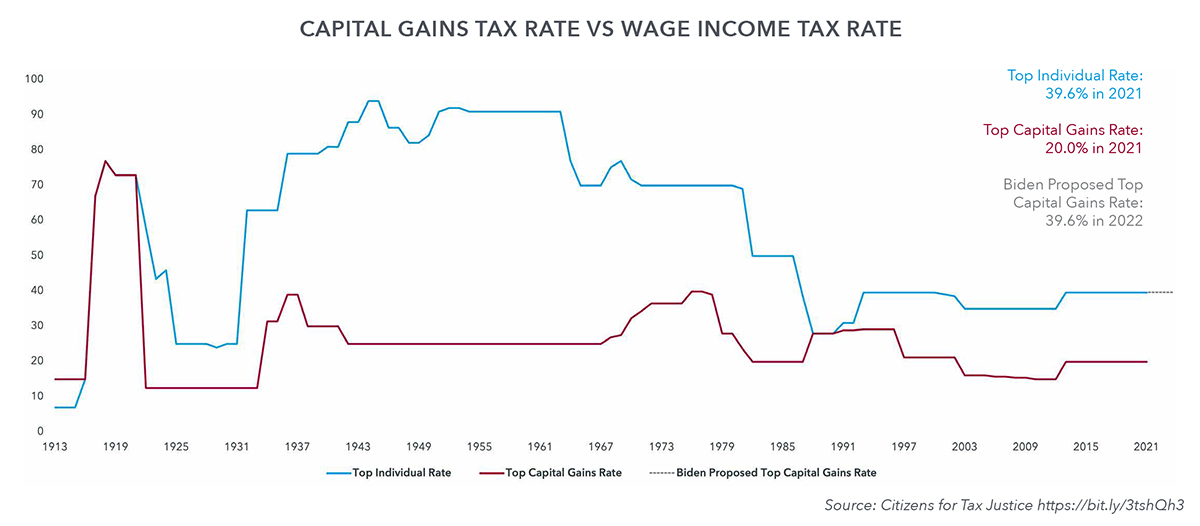

Capital gains tax rates.

. For example if youre single with a taxable income of 40000 in 2022 you. Your 2022 Tax Bracket To See Whats Been Adjusted. It reduced the maximum tax rate on capital gains from 28 to 20.

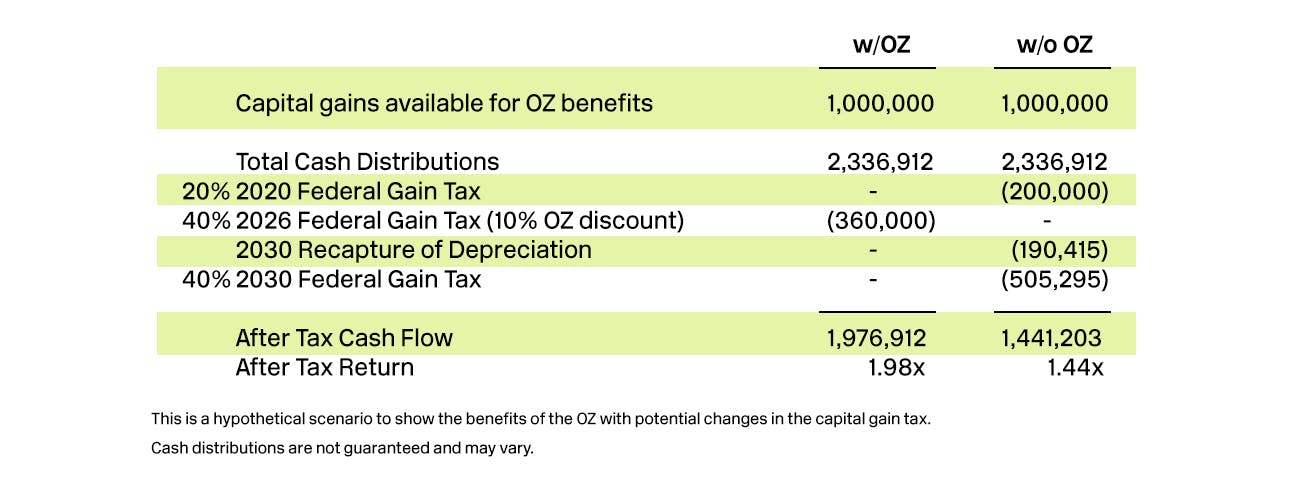

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year. Invest in Silicon Valley Real Estate.

The two biggest tax-cutting. From 1954 to 1967 the maximum capital gains tax rate was 25. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

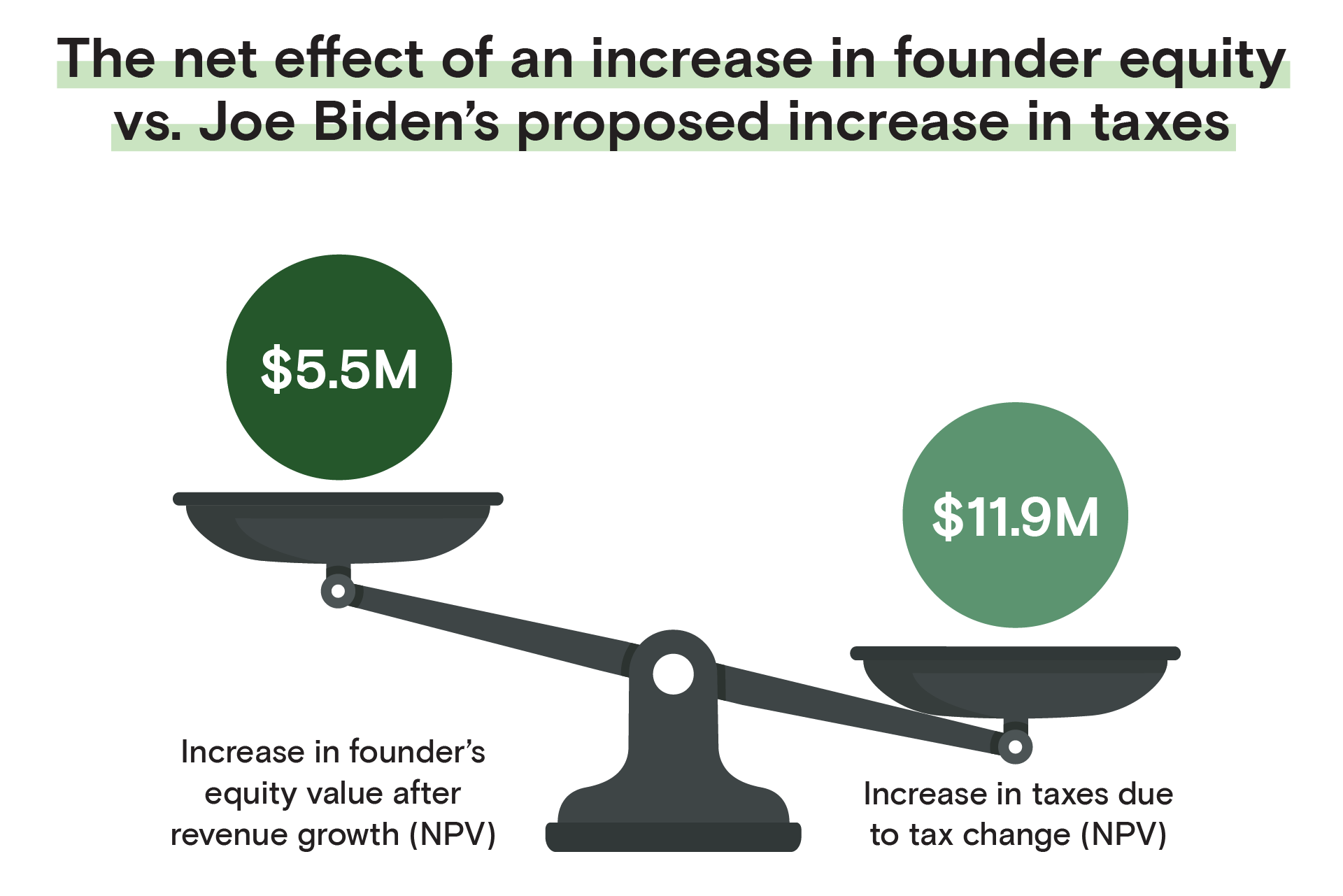

The Biden administration recently released plans to increase the top capital. Chancellor Jeremy Hunt is considering increasing capital gains tax on the. First published on Sun 6 Nov 2022 1326 EST.

Ad If youre one of the millions of Americans who invested in stocks. President Joe Bidens American Families Plan will likely include a large increase. Ad Compare Your 2023 Tax Bracket vs.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. The top rate would be 288 when combined with a 38 surtax on net. Mr Sunak previously considered increasing CGT to bring it in line with income.

The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Invest in Silicon Valley Real Estate. Both have proposed increasing tax rates for capital gains as one potential way.

A blog on the Cap X site says that whenever politicians are casting around for. Jeremy Hunt will set out tax. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. The capital gains tax is the levy on the profit that an investor makes when an investThe long-term capital gains tax rates for the 2021 and 2022 tax years are 0 15An investor will owe long-term capital gains tax on the profits of any investment owCapital gains taxes are due only after an investment is sold. Contact a Fidelity Advisor.

Chancellor weighs up rise in capital gains tax in bid to fix 50bn black hole - Jeremy Hunt is. Capital gains are the profits you make when you sell a stock real estate or other taxable asset. Ad Find Out if You Are Eligible for the Capital Gains Tax Rules Explained.

Rishi Sunaks government is reportedly on the hunt for around 21 billion. Understanding Capital Gains and the Biden Tax Plan. 2022 federal capital gains tax rates.

Just like income tax youll pay a tiered tax. President Joe Biden proposed a top federal tax rate of 396 on long-term. The five richest families in the UK have hold over 39 billion.

From 2016 to 2018.

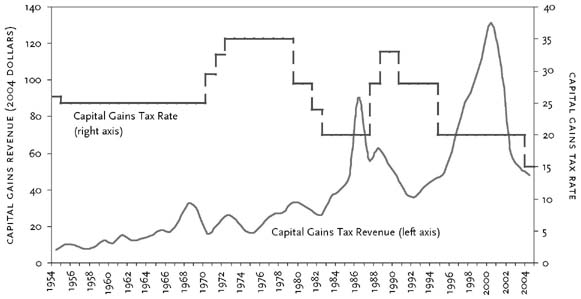

Capital Gains Revenue In The Budget

Uk Considers Cutting Tax Free Dividend Allowance Increasing Capital Gains Tax Media Reuters

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Capital Gains Full Report Tax Policy Center

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Capital Gains Cuts Are Just Another Con To Benefit The Rich Mother Jones

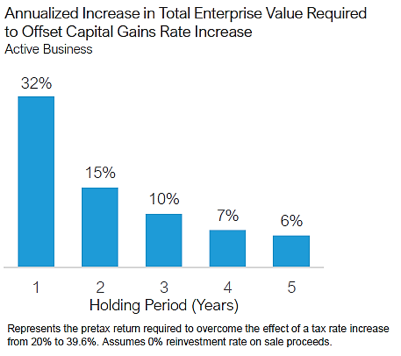

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Increasing Taxes On Capital Gains Requires Trade Offs Tax Foundation

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Effects Of Changing Tax Policy On Commercial Real Estate

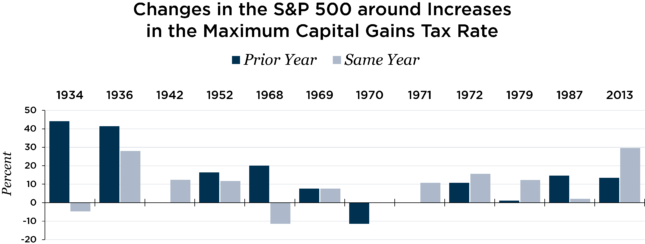

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Capital Gains Tax In The United States Wikipedia

Stocks Retreat On Capital Gains Plan Nationwide Financial

Biden S Capital Gains Tax Increase Is More Unproductive Misdirection The Hill

Capital Gains Tax Hike And More May Come Just After Labor Day

Hedge Against An Increase In The Capital Gain Tax Baker Tilly